Pre Seed Cap Table

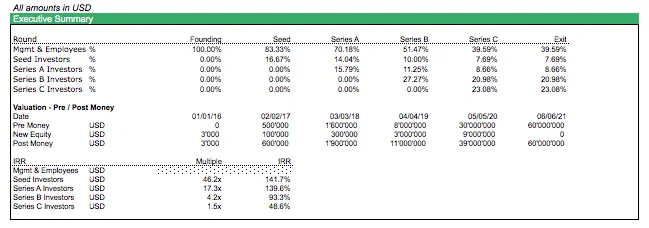

The short answer: the company has only issued 6m shares, and 8% of 6m is 480,000. the slightly longer answer: the key point here is the distinction between "authorized" and "issued" shares. issued shares, as the name suggests, are shares that h.... The pre-seed investors had also required the creation of an options pool of 100,000 (8.07%) options. the creation of this cap table prior to angel investment is more fully discussed in our post on pre-seed investment cap tables for startups. increasing the stock options pool. This is a guide to how to use my template cap table and returns analysis excel spreadsheet. this will enable founders to track the ownership of their startup from founding up to series-c as well as what returns will be generated upon exit (across different valuations)..

Therefore, it is absolutely critical either to (1) have your law firm prepare a pro forma cap table as early in the term-sheet process as possible, or (2) at minimum, ask the law firm to review and provide comments on the pro forma that has been prepared by the principals � before it is agreed upon.. A cap table will show shareholder splits, the fully diluted position, and in some cases returns and other analysis. you may like to try out reportally - it has a cap table builder built in, with runs the number for you, and outputs in a standardised way. and its free for startups.. Financial model template to create a cap table through multiple rounds of investments, and forecast how investment rounds impact ownership, dilution, valuations, and distribution of proceeds to entrepreneurs and investors through a detailed exit waterfall. used by investors, lawyers, and pre-seed, seed, a, b, c, and post-funding stage companies..

Comments

Post a Comment